Become a Scam-Spotting Pro

Every day, thousands of people fall victim to fraudulent emails, texts, and calls from scammers pretending to be their bank, a loved one, the government, or law enforcement. And in this time of expanded use of online and mobile banking, the problem is only growing. In fact, the Federal Trade Commission's report on fraud estimates that American consumers lost a staggering $12.5 billion to phishing scams and other fraud in 2024 - an increase of 25 percent over 2023.

These criminals are skilled at tricking you- convincing you to trust them, pay them, and act fast. It's time to snap out of it.

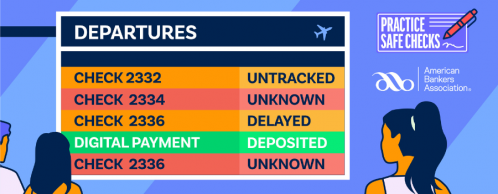

At Security Financial Bank, we're committed to helping you spot scams. We've joined the American Bankers Association and banks across the country in a nationwide effort to help you realize when you're under a scammer's trance and snap out of it, so you avoid losing your money.

We want every bank customer to become a scam-spotting pro - and stop these criminals in their tracks. If something feels off, stop, take a breath and trust yourself.

Five red flags to look out for:

- You're pressured to log into or send money with payment apps - Snap out of it.

- You're contacted out of the blue, asked to act immediately, and to keep it a secret - Snap out of it.

- You get a text that includes a suspicious link - Snap out of it.

- You're emailed an attachment that you weren't expecting - Snap out of it.

- You're asked for personal information like your PIN number, passwords, or Social Security number - Snap out of it.

You've probably seen some of these scams before. But that doesn't stop a scammer from trying. For tips, videos, and an interactive quiz to help you keep criminals at bay, visit BanksNeverAskThat.com.